Wedding Budget Management

Master Your Wedding Finances

Wedding budget management is the foundation of successful wedding planning, affecting every decision from venue selection to vendor choices. A well-structured budget provides the financial framework that guides all planning decisions while ensuring that your celebration reflects your priorities without creating long-term financial stress. Effective budget management transforms wedding planning from a potentially overwhelming financial commitment into a manageable investment in your future together.

Modern wedding budgets are complex financial instruments that must account for multiple variables, hidden costs, and unexpected expenses while maintaining flexibility for changing priorities and market conditions. Unlike other major purchases, weddings involve dozens of individual vendors, services, and products that must be coordinated within a single financial framework. This complexity requires sophisticated budgeting approaches that go far beyond simple expense tracking.

The key to successful wedding budget management lies in understanding that your budget is both a planning tool and a decision-making framework. Every wedding choice has financial implications, and every financial decision affects your celebration options. Couples who master budget management find that financial clarity actually increases their planning enjoyment by eliminating uncertainty and enabling confident decision-making throughout the process.

Establishing Your Total Wedding Budget

Determining your total available wedding budget requires honest assessment of current financial resources, future earning potential, and long-term financial goals. Many couples make the mistake of setting unrealistic budget expectations based on dream wedding visions rather than actual financial capabilities. The most successful approach involves calculating a comfortable spending amount that won't compromise other important financial objectives like home purchases, debt reduction, or retirement savings.

Family contribution coordination adds complexity to budget establishment, especially when multiple parties are contributing funds with different expectations about decision-making involvement. Clear communication about contribution amounts, timing, and decision-making authority prevents misunderstandings that could create family tension during an already emotional planning period. Written agreements about family contributions help ensure that everyone understands their roles and responsibilities.

Budget timing considerations affect both planning flexibility and financial stress management. Couples who establish budgets early in the engagement period have more vendor options and better negotiating power, while those who delay budget planning often face limited choices and premium pricing. Payment timing coordination ensures that major expenses don't create cash flow problems or require expensive financing solutions.

Professional Budget Tools

Take control of your wedding finances with sophisticated budget tracking tools at planning.wedding/budget – designed for comprehensive expense management and cost optimization.

Wedding Budget Examples

Explore these professional wedding budget designs to inspire your own financial planning. Each example demonstrates different approaches to expense tracking, cost allocation, and financial management strategies.

Digital Budget Tracker

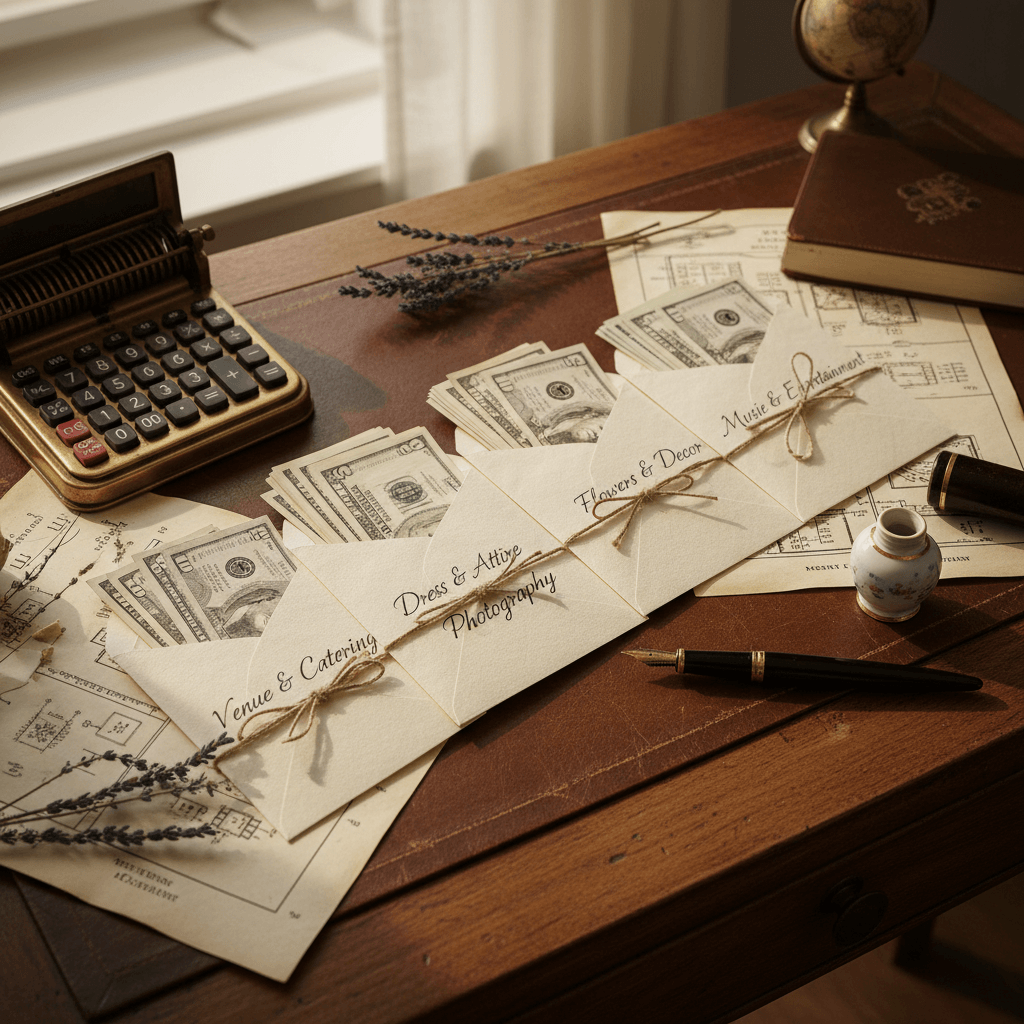

Envelope Budget System

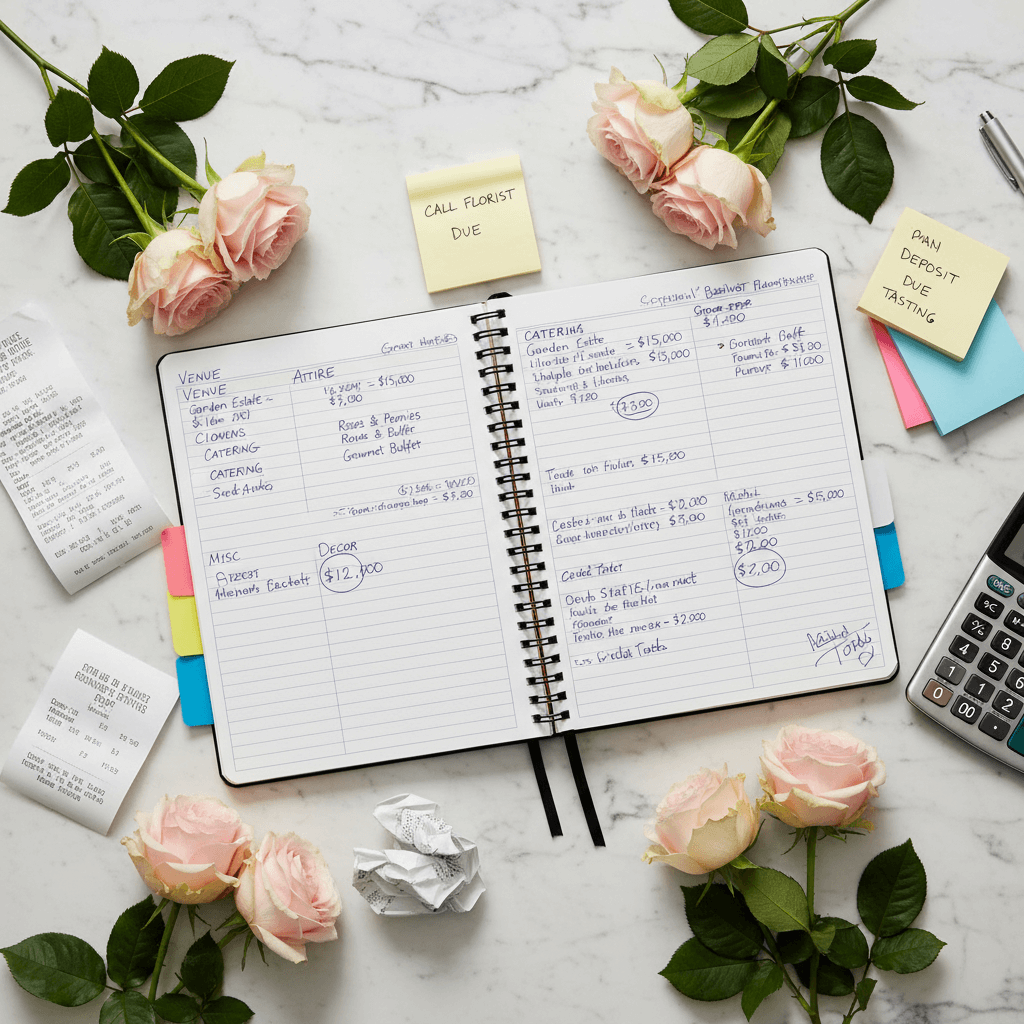

Comprehensive Budget Planner

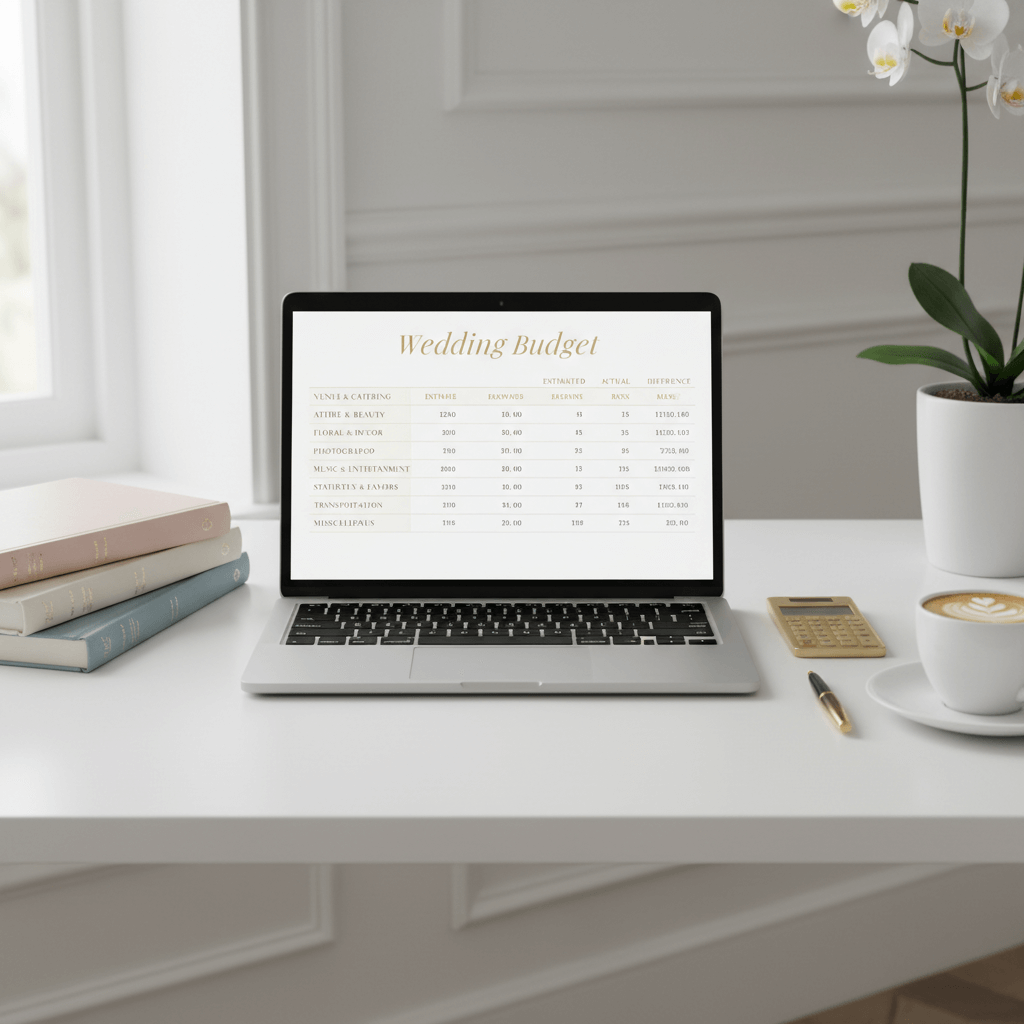

Advanced Spreadsheet System

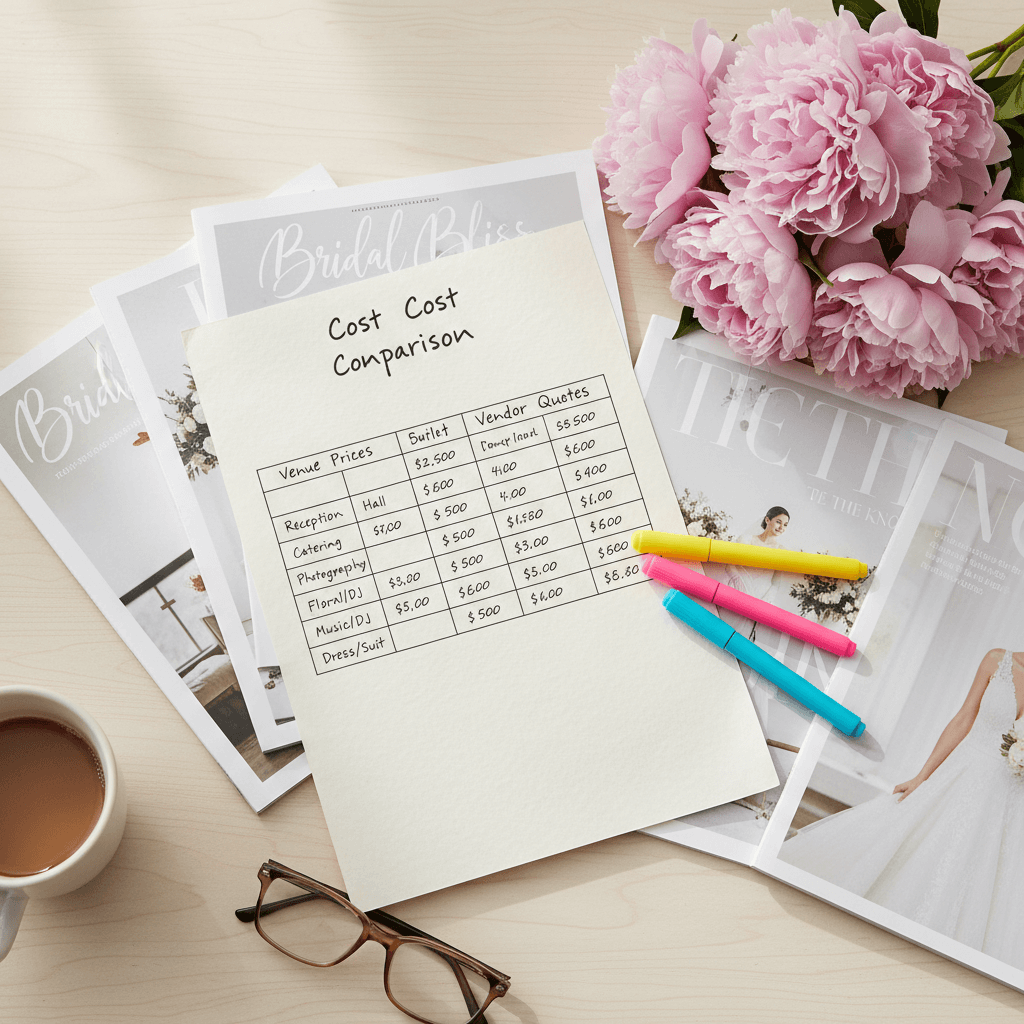

Cost Comparison Analysis

Savings Goal Tracker

Category Allocation and Priority Setting

Effective wedding budget allocation requires understanding typical expense distributions while adapting them to your specific priorities and celebration style. Traditional allocation guidelines suggest spending 40-50% of your budget on venue and catering, 10-15% on photography and videography, and 8-10% on flowers and décor. However, these percentages should be adjusted based on your personal priorities and celebration preferences.

Priority-based budgeting allows couples to allocate larger percentages to their most important elements while reducing spending in less critical areas. Couples who prioritize photography might allocate 20% to visual documentation while reducing floral expenses, while those focused on guest experience might increase catering allocations while choosing simpler photography packages. This customized approach ensures that your budget reflects your values and priorities.

Hidden cost identification prevents budget surprises that can derail financial planning. Service charges, gratuities, tax implications, and vendor fee structures often add 15-25% to quoted prices. Comprehensive budgeting accounts for these additional costs from the beginning rather than treating them as unexpected expenses that require budget adjustments or compromise other planning elements.

Vendor Cost Management and Negotiation

Vendor cost management involves more than just comparing prices – it requires understanding value propositions, service inclusions, and long-term cost implications. The lowest-priced vendor isn't always the most cost-effective choice when service quality, reliability, and included features are considered comprehensively. Effective vendor evaluation considers total cost of ownership, including potential additional fees, change order costs, and service guarantee implications.

Negotiation strategies can significantly impact overall wedding costs when applied appropriately and professionally. Package modifications, service timing flexibility, and payment schedule negotiations often provide savings opportunities without compromising service quality. However, aggressive negotiation tactics can damage vendor relationships and potentially affect service delivery, making diplomatic negotiation approaches more effective long-term.

Contract review and cost protection measures ensure that agreed-upon prices remain stable throughout the planning period. Inflation protection clauses, service guarantee provisions, and change order limitations prevent vendor price increases that could disrupt budget planning. Understanding contract terms also helps couples avoid unexpected fees that can significantly impact final costs.

Tracking and Monitoring Systems

Real-time budget tracking provides the information necessary for informed financial decision-making throughout the planning process. Modern budget management systems integrate with vendor payments, contract management, and planning timelines to provide comprehensive financial visibility. This integration eliminates the manual tracking that often leads to budget discrepancies and financial surprises.

Cash flow management ensures that wedding expenses don't create financial stress or require expensive financing solutions. Understanding when major payments are due allows couples to plan savings and manage other financial obligations appropriately. Payment timing coordination also provides opportunities for early payment discounts and helps avoid late payment penalties that can increase total wedding costs.

Budget variance analysis helps identify areas where spending is exceeding planned allocations while there's still time to make adjustments. Regular budget reviews allow couples to reallocate funds between categories or identify areas where additional savings might be necessary. This proactive approach prevents budget overruns that could affect other financial goals or create post-wedding financial stress.

Cost-Saving Strategies and Value Optimization

Strategic cost reduction focuses on maximizing value rather than simply minimizing expenses. Understanding which wedding elements provide the greatest guest impact allows couples to allocate resources effectively while identifying areas where savings won't significantly affect the celebration experience. This approach ensures that cost-saving measures enhance rather than compromise overall wedding quality.

Timing optimization can provide significant savings through off-season pricing, weekday celebrations, and advance booking discounts. Friday and Sunday weddings often cost 20-30% less than Saturday celebrations, while off-season timing can reduce venue and vendor costs significantly. However, timing decisions should balance cost savings with guest convenience and weather considerations.

DIY project evaluation helps couples identify areas where personal involvement can reduce costs without compromising quality or increasing stress. Successful DIY projects typically involve time-intensive but skill-appropriate tasks like invitation assembly, simple décor creation, or favor preparation. However, critical timeline elements like flowers, photography, or day-of coordination should remain professional to ensure celebration success.

Advanced Budget Management

Access comprehensive wedding budget tools and financial planning resources at planning.wedding – designed to help couples achieve their dream wedding within their ideal budget.

Emergency Fund and Contingency Planning

Wedding emergency funds provide financial protection against unexpected costs, vendor changes, or market fluctuations that could affect celebration plans. Financial experts recommend allocating 5-10% of total wedding budget for contingency expenses, though destination weddings and complex celebrations might require larger emergency reserves. This contingency planning prevents emergency situations from creating financial stress or forcing major celebration compromises.

Vendor backup planning includes understanding replacement costs and alternative service options in case primary vendors become unavailable. This planning should include budget implications of vendor changes and identification of acceptable alternatives within existing budget constraints. While vendor problems are relatively rare, having financial contingency plans provides peace of mind throughout the planning process.

Market fluctuation protection becomes important for couples with long engagement periods, especially during periods of economic uncertainty. Understanding how inflation, market changes, and seasonal variations might affect vendor pricing helps couples make informed timing decisions and budget adjustments. Some couples choose to prepay major vendors to lock in current pricing and avoid potential increases.

Post-Wedding Financial Management

Final expense reconciliation ensures that all wedding costs are accurately tracked and that any remaining budget funds are allocated appropriately. This process involves confirming final vendor payments, tracking gratuities, and accounting for any last-minute expenses that occurred during the celebration. Accurate expense tracking supports tax preparation and provides valuable information for couples planning future celebrations.

Thank you gift budgeting should be planned in advance rather than treated as a post-wedding surprise expense. Gifts for wedding party members, family contributors, and key vendors represent important relationship investments that deserve appropriate budget allocation. Planning these expenses in advance prevents them from affecting other budget categories or creating post-wedding financial stress.

Financial transition planning helps couples adjust their financial management systems from wedding planning mode to married life financial planning. This transition involves closing wedding-specific accounts, updating insurance policies, and establishing new financial goals that reflect married life priorities. Successful financial transition ensures that wedding planning financial discipline continues into married life financial success.